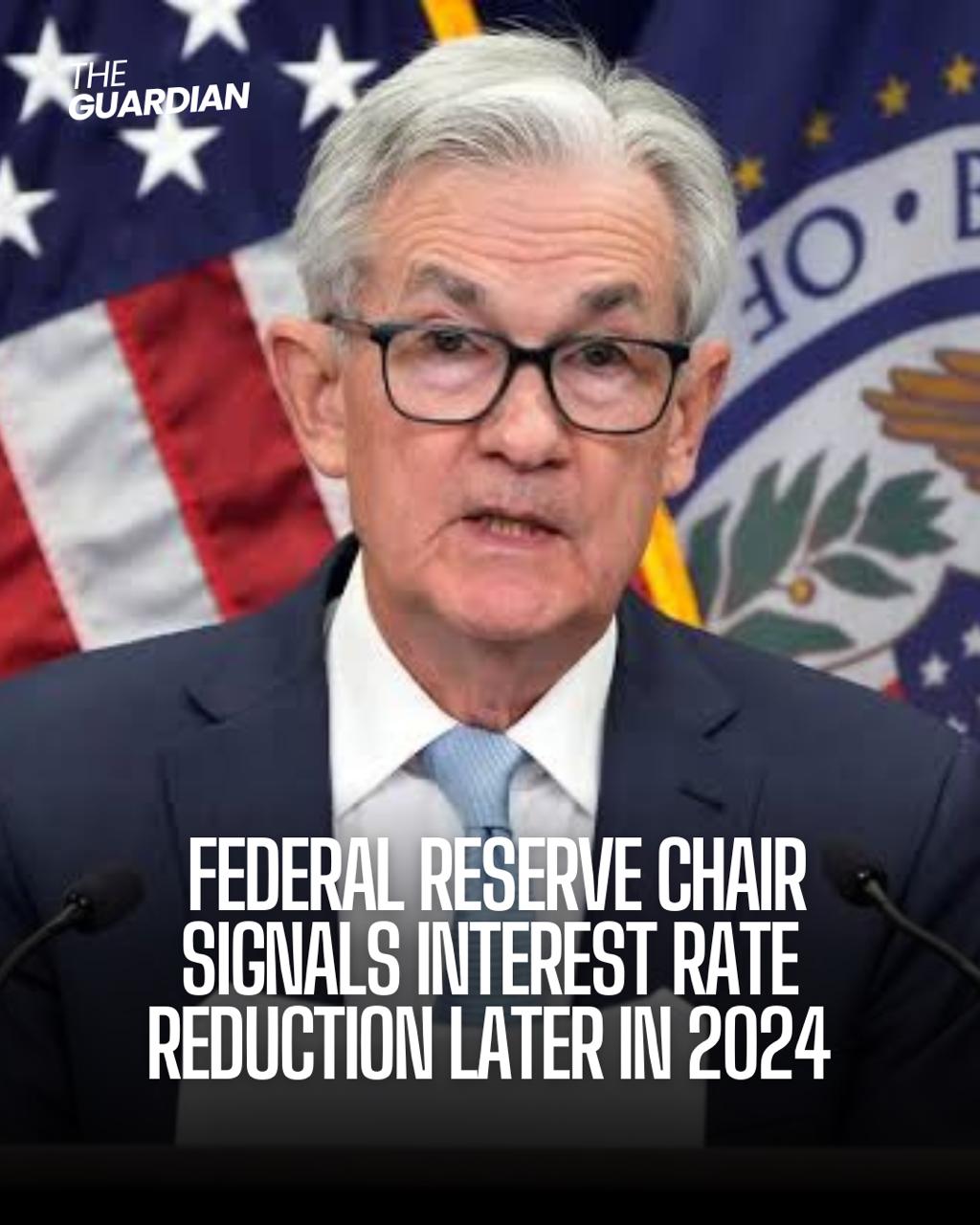

In comments prepared for a House committee, the central bank leader warns that continued headway on inflation ‘is not assured.‘

In his remarks to the House financial services committee on Wednesday, Jerome Powell, the chair of the US Federal Reserve, indicated that the central bank still anticipates reducing its benchmark interest rate later this year.

However, he cautioned that continued progress on inflation remains uncertain.

Expectations for Interest Rate Reduction

Powell stated that if the economy progresses as anticipated, it would likely be appropriate to start dialing back policy restraint at some point in 2024.

This statement comes amid mounting concerns about inflation and as US lawmakers brace for a presidential election year.

Uncertain Economic Outlook

Despite the expectation of a potential rate reduction, Powell emphasized the uncertain economic outlook and the lack of assured progress toward the Fed’s 2% inflation target.

Also read: Fatal plane crash in West Nashville, US

He highlighted the risks of cutting rates too soon and reigniting inflation, as well as the risks of maintaining tight monetary policy for too long and potentially harming the ongoing economic expansion.

Inflation Trends and Policy Decision

While inflation has moderated since reaching four-decade highs in 2022, Powell stressed the need for greater confidence in its continued decline before considering rate cuts.

Recent economic data has provided little clarity on the direction of inflation, with differing projections from analysts and investors expecting rate cuts to commence in June.

Impact on Economic Landscape

Powell’s testimony coincides with inflation nearing the Fed’s target of 2% and the economy displaying unexpected strength.

Despite maintaining the policy rate at its highest level in over 20 years, overall financial conditions have been easing, leading to rising asset prices.

This dynamic could complicate efforts to tame inflation and extend the debate over the timing of rate cuts.

As policymakers navigate these challenges, their decisions will shape the economic landscape during a pivotal presidential election year, with incumbent Joe Biden facing off against former president Donald Trump.