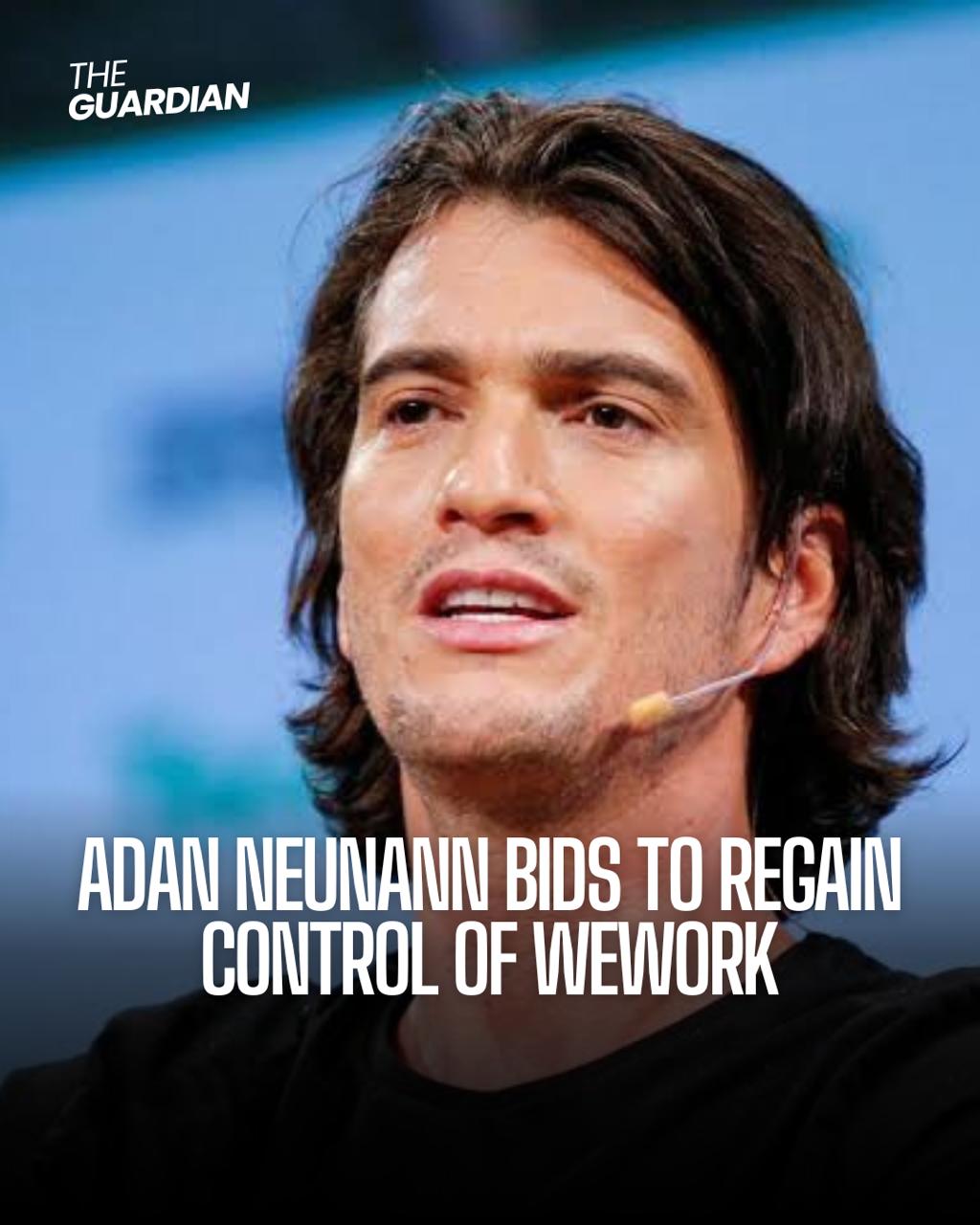

The ex-CEO of a shared office space rental firm has reportedly been in discussions with investors.

Background

Adam Neumann, the co-founder ousted from WeWork, has made a bid exceeding $500 million in an endeavor to reclaim control of the troubled shared office space rental company he launched in 2010.

Bid Details

Neumann’s property company, Flow, disclosed the bid on Monday, stating that it was submitted with the support of “a coalition of half a dozen financing partners.” The bid, as reported by The Wall Street Journal, surpasses $500 million.

Response from WeWork

WeWork acknowledged the bid, noting that they routinely receive expressions of interest from third parties.

The company emphasized that its board and advisers are reviewing the offer to ensure decisions align with the long-term interests of the company. WeWork reiterated its commitment to ongoing restructuring efforts following its Chapter 11 bankruptcy filing in November.

Neumann’s Previous Attempts

Also read: Biden promises full Federal funding for rebuilding bridge

It was revealed last month that Neumann had been pursuing discussions with WeWork for months, exploring options to either acquire the company outright or provide it with debt financing.

Neumann’s new venture, Flow Global, engaged in discussions with WeWork advisers, indicating a potential joint bid with investors, including Third Point, a US hedge fund.

Response from Third Point

Third Point clarified that while they had preliminary conversations with Neumann, they had not committed to any financial support for a potential deal with WeWork. They emphasized that discussions were exploratory in nature.